Preparing for the Future of the Family Business.

By Bruce Tannas

Currently, half of first-generation Canadian family businesses are expecting the next generation will be the majority shareholders in five years’ time. And many Canadian family businesses are concerned about keeping their business in the family (Family Business Survey 2021—Canadian insights). So, many family businesses in Canada will be transitioning to the next generation with or without the benefit of family business succession planning.

If you have family involve in the business, then you need to think about and discuss how the family business will transition to the next generation or even if it will at all. Therefore, it will be important to do some family business succession planning as it will be key to the long-term health of the business and the family.

Multi-Generational Family Businesses

In Canada, we have family businesses that are big (e.g., Rogers, McCain’s, & Sobeys) and small. We also have single and multi-generational family businesses.

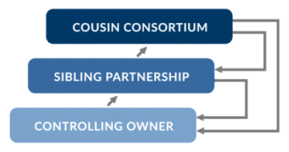

Multi-generational companies start with the founder(s) (one owner and their spouse) which is known as the controlling owner stage. Then if the company is transitioned to the next generation of siblings this is known as the sibling partnership. Finally, the third generation is known as the cousin consortium (see figure). (for more information see – Stages of Development of the Family Business)

Family business transitions from one generation to another isn’t always easy. There are some often cited statistics that suggest that only 1/3 of companies make it through the second generation and only 13% make through the third generation. However, in an interview with Shauna Feth of the Alberta Business Family Institute, Shauna says that “…there is really not good stats around transitions from generation to generation because we concentrate on the operating company. There also may be ownership, assets, and/or wealth being transferred from generation to generation which are not accounted for in the statistics. ”

But even when we look at the operating company alone, there can be generational resiliency. An article entitled Do Most Family Businesses Really Fail by the Third Generation? asserts that family businesses often outlast that average tenure of non family businesses. They also tend to be more resilient in tougher times. The key is to have engaged ownership and a next generation that is interested in carrying on with the company.

Viewpoints of All Parties’ Matter

Family businesses are unique in that that involve personal relationships, money, and business relationships. That’s because a family business is really three things: a family, an ownership group, and an operating company. Each family member can belong to one or more of these groups and therefore may have different perspectives on the family business (for more on that see A Look at Family Business in Canada).

For the benefit of the family, there needs to be conversations about where the family is going with the business and everyone’s role in it. But sometimes “these conversations don’t happen because we are scared of conflict. We are scared to ask the questions we might not like the answers too” says Shauna Feth. If the family and the business is going to survive, through the long run, there is a “…need for conversations about future expectations of family members” says Shauna.

Some of these conversations can indeed be difficult. According to an article in the Harvard Business Review, “Choosing a successor to the CEO can be an extremely sensitive topic in a family business. The relative currently at the top may even be deeply resistant to the notion of being replaced – and vocal about it.”

Also, not all the family members are interested in being active in the business. In an article entitled Thriving or Trapped in the Family Business? cautions about assuming family members want to or are even suitable to take over the business. While there may also be circumstances where family members may be interested in taking a role (or taking over) in the company and haven’t voiced that desire yet.

Regardless of the outcome of the conversations about current and future family roles in the business, it is better to have the conversations than not. There may be lost opportunities for family member(s) to take over if these conversations don’t happen. Also, Shauna says that “I don’t see that it is unsuccessful succession planning if a family has these conversations and decides that there isn’t someone to take the business over.”

Family Business Succession Planning

Succession planning is the process of developing a written plan for an occasion when an owner decides, or is forced, to step down from an ownership and leadership role in the business. This transition will eventually happen regardless of whether or not there is a family business succession plan in place. Life happens and one or more of 4 d’s (death, disability, divorce, or dissolution) could determine the future course of the company.

According to Shauna, “What you don’t want is a failure to plan because that can have huge repercussions for your family.” Like “…the widow that isn’t involved in the day to day and the husband dies she doesn’t know anything about the business…who the accountant is or the lawyer…don’t leave your family in the dark because at a time of incredible grief because it becomes so much more stressful also trying learn to run a business.”

Shauna also has seen situations “where one sibling is working in the business and the others aren’t and the founder dies leaving the business equally to all the siblings without a thought to the contribution of the one working in the business”. That’s because no one thought about “what is fair vs. equal because when you leave an equal share in the business to all the siblings it doesn’t take into account their individual contributions (or lack thereof) to the business.”

So, these conversations need to be had and all the family members should be involved to some degree or another with the succession planning. These conversations should be held from the family perspective, the ownership perspective, and the operation of the company perspective.

The key is to start as early as possible because a proper family business succession takes planning and time. Shauna Feth says you should “start today, start researching resources are out there and reach out to organizations, such as the Alberta Business Family Institute, to help with the planning”.

Connect4Commerce offers entrepreneurs and small business owners across the country a convenient and comprehensive place to connect, exchange goods and services, and advance their businesses. Be sure to check out further articles in our Small Business News Blog for additional resources. Also, find professionals on our site that can help you with buying or selling a business. If you plan to sell your business, make sure to learn how to list your business on Connect4Commerce—Canada’s preferred marketplace for business.